- Free Home Budget Software For Mac

- Business Budget Software Reviews

- Budget Software For Mac Free Download

- Free Home Budget Software For Mac

Accounting is terribly important when it comes to your monthly budgets. Whether they are personal expenditures or business related, you have to keep track of all the money that you spend at all times. This is even more important to note when you have a Mac since you probably have enough money to store or invest since professionals tend to lean more towards these powerful devices. Probably the only problem that you may experience though is that sometimes you can’t find the right piece of software for your financial problem. There is no reason to fret though, as there is tons of budgeting software for Mac that you can use to help you out with your issues.

10. iCash SE

iCash SE is an app openly available for purchase by Mac users at the low price of $30. It features a couple of standard aspects in accounting, like simple budgets and tracking where your money is. However, it is also expansive enough for small businesses as it can also track payrolls and income streams. You can also set certain targets with the help of this program and will surely aid you in allocating all your funds.

9. Squirrel

If you’re not too keen on a program that can be used by small business because all you want is concise tracking of your personal finances, then Squirrel is the choice for you. It’s fairly straightforward in that it has budgeting tables but it also mixes it up by adding on a schedule for transactions that you need done in a short span of time. Couple that with progress reports to set your goals in saving, and you get a pretty powerful personal finance app.

8. CheckBook

This program has a very descriptive title as it tells you which part of your finances it covers really well. CheckBook concentrates solely on your spending from your debit card and how many deposits you may have made to the bank. It helps you ‘balance the checkbook’ as one would say, and it does so with enough features that you feel totally in control.

Goodbudget is a personal finance app perfect for budget planning, debt tracking, and money management. Share a budget with sync across multiple phones (and the web!). MANAGE MONEY WITH PEOPLE YOU LOVE Goodbudget is perfect for sharing a budget with a spouse, family member, or friend. America's Best Selling Budgeting. Software for a Limited Time. Trusted for over 30 years by over 17 million members. Backed by our 30 day money back guarantee. Protected by our robust 256-bit encryption. Expert support team is here to help, for free.

7. Simplibudget

:max_bytes(150000):strip_icc()/GettyImages-748345779-5aa2ff8b6bf069003673b93a.jpg)

The reason why Simplibudget doesn’t take a higher slot in this list is because of its purpose. The program is barebones simple, which is also why it deserves a look from you. You are allowed enough control so that you can make concise decisions about your spending without the hassle of controlling all of the parts of your portfolio.

6. iCompta

This program is well balanced, and that should speak volumes about it. Instead of concentrating on one aspect, it takes all of them and creates a reasonable program which is simple enough to use, but has enough depth to keep your finances, savings, and investments well in check. At the same time, it carries a decent price tag. Couple that with a free app on both the iPad and the iPhone, and you get a program that is very diverse and can jump over to your other devices easily.

5. Moneywhiz

Moneywhiz is the first on this list to feature a very in depth look at your finances. It reaches back through your financial history and records each part of it so that you have hindsight at what you did right, and what you did very wrong when dealing with your money. Boasting a full plethora of features, there is no doubt that this program is great. The only downfall is that it carries a pretty substantial price tag and is only located on the iPad and iPhone.

4. Cashculator

While cashculator is a fairly simple app, there is a reason why it is here on the upper half of the list. This program takes a different approach to your finances and doesn’t necessarily fall into the norms within this list. You see, the program only asks two things of you to work; your income and your expenses. This helps it calculate the best route you should take when spending money, and insists you make smarter decisions with your cash.

3. MoneyDance

This program is not for those with little experience in accounting. However, it is suitable for those who have a lot of money stored away in different locations. Boasting connections to hundreds of financial institutions, you can rest assured that if your money moves anywhere, you’ll be alerted by this app. At the same time, it also details a number of online services under monitoring and ensures that all your transactions are posted in your interactive progress reports. The heavy detail in this program is what makes it a top contender for your money, and it only falls slightly low because the program costs $50.

2. iBank

This program takes a top slot when it comes to personal finance tracking. What other programs on this list usually lack, this program makes up for and even excels at. It has detailed information on almost anything you’ve ever done with your money as it tracks your old finance reports, transactions, and the money you may have saved. It’s also got an extensive tracker for your money, covering both investments and savings and integrating them into one neat little package with a very intuitive User Interface that is guaranteed to keep you on track with all the money you may have spent.

1. Money

There are many reasons why Money takes the top slot as the best budgeting software for Mac software you can purchase for your personal finances. It could be that it tracks and actively updates your portfolio, or maybe it can keep tabs on almost all your accounts. Both are very valid reasons why you should buy and use this app immediately, however, the real reason is very evident. It is because the app itself manages to control all these modules with one very well unified User Interface and additionally, because it does so quickly and efficiently. It takes the top spot simply for being great at what all the programs on the list do.

Quicken was once the go-to budgeting tool. I used it when it was first released in the 1980s. Today, it’s been eclipsed by apps that enable you to manage every aspect of your finances, often for free. Here are the best Quicken alternatives to consider in 2021.

Free Home Budget Software For Mac

Editor’s Top Picks

Of all the options out there to replace Quicken (and Mint for that matter), three stand out among the rest:

- Personal Capital–It’s both free and comes with the a robust set of features unmatched by other alternatives. It easily handles budgeting, net worth, cash flow, retirement investments and taxable investments. It also comes with excellent tools, including a retirement calculator, investment fee analyzer and investment portfolio analyzer. Personal Capital can now even track Bitcoin, Ethereum, Litecoin and thousands of other tokens. It’s the tool I use every day.

- Tiller–If you are a diehard spreadsheet fanatic, Tiller is the answer. It integrates with Google Sheets and can connect your bank accounts and credit cards. It also offers daily email updates to track your spending. You can try it free for 30 days, then it’s $79 a year.

- YNAB (You Need a Budget): For those who want to focus exclusively on budgeting (no investments), then YNAB is an ideal choice. It does budgeting as well as any app available today, and its community is second to none.

Alternatives to Quicken

- Top Quicken Alternatives

Top Quicken Alternatives

1. Personal Capital–Editor’s Choice

Personal Capital is the clear winner when it comes to finding a substitute for Quicken. It’s free and it offers tools to manage every aspect of your finances. With Personal Capital, you can link just about every financial account you have–checking, savings, credit cards, retirement accounts, investments accounts, HSAs, and even your home (via Zillow).

Once linked, Personal Capital’s financial dashboard offers valuable insights into your finances. As an example, the tool enables you to–

- Track your spending by category

- Estimate when you can retire

- Calculate the cost of your investments

- Display the asset allocation of your portfolio

- Generate a net worth statement

- Get alerts when bills are due

- Evaluate your investment portfolio

- Save for emergencies

- New: Track Bitcoin, Ethereum, Litecoin and thousands of other tokens without giving access to your crypto wallet.

I’ve used Personal Capital for years. It’s the only option that in my opinion can handle every aspect of my finances, from budgeting to investing to retirement planning.

I’ve written a detailed review and guide of Personal Capital that you can check out.

2. Tiller Money–Best Spreadsheet Budget

I don’t know how they do it, but Tiller Money has figured out how to turn a Google Sheet into a dynamic budgeting tool. You link your bank accounts and credit cards to Tiller’s Google Sheet tool, and it automatically downloads all of your transactions. From there you can create budgets, categorize spending and generate reports.

I’ve been using Tiller for several months for both my personal budget and my small business budget. It’s clear that Tiller is ideal for those who love working with spreadsheets. I will caution you that setting up Tiller can be a bit intimidating. The good news is that they have videos to walk you through each step. If I can do it, you can do it.

One thing to keep in mind is that you must manually categorize each transaction. For some, this is a show-stopper. They want the convenience of tools like Personal Capital that automate this process. For others, they would prefer to categorize transactions themselves. It forces them to look at each entry, understand how they spent money, and then properly categorize the expense.

There is no right or wrong here. It comes down to preference. You get a 30-day free trial. After that Tiller costs $79 a year.

3. You Need a Budget (YNAB)–Best for Budgeting

YNAB is ideal for those looking just for a budgeting tool. In my view, there is no better app when it comes to creating a budget. YNAB’s interface is similar to a spreadsheet. The tool makes it easy to budget by category based on the money you actually have in the bank.

One of YNAB’s core principles is to give every dollar a job. You do that by deciding how you’ll spend every dollar that enters your checking account. As with other tools, you can connect your bank accounts and credit cards to YNAB. This allows for real-time updates so that you can track your spending throughout the month.

YNAB doesn’t have the rich feature set offered by Personal Capital. That’s particularly clear when it comes to investing. For those who don’t want to track investments, however, YNAB is a good option.

It’s not free, however. You can try it free for 34 days. After that it costs $11.99 a month or $84 a year for the annual plan. The cost is the biggest downside to YNAB.

4. PocketSmith–Best for Calendar Budgeting

PocketSmith started out as a calendar to plan upcoming income and expenses. Today, it’s a full-fledged budgeting app. You can synch your accounts with PocketSmith. Once synced, you can track your budget and you’re net worth. You can also see your income and spending in a handy calendar view.

One stand-out feature is PocketSmith’s auto-budget tool. It can create a budget for you based on past spending. It also has a cash flow feature that maps income and spending by date range.

While there is a free version of PocketSmith, it requires manual data entry. To get automatic bank fees, you’ll need to pay at least $9.95 a month, or $7.50 a month when paid annually.

5. CountAbout–Imports from Quicken or Mint

If you have a lot of data in Quicken (or Mint), CountAbout may be the budgeting tool for you. It has a feature enabling you to import data from Quicken or Mint.

CountAbout enables you to download transactions from your bank and customize both income and expense categories. You can even attach receipt images to expense transactions. You can set up recurring transactions and generate financial reports.

For the features you get, the cost is very reasonable. The basic plan costs just $9.99 a year (not a month). If you want automatic downloading of bank transactions, the cost is $39.99 a year.

6. Moneydance–Traditional Budgeting Software

With so many apps going online, Moneydance takes a different approach. You download Moneydance software rather than use it online. Once downloaded, the software works much like you would expect.

You can download banking transactions into the software and initiate bill pay. The software automatically categorizes expenses based on how you categorize them. In other words, it learns from your use of the program.

It offers a dashboard (shown above) that summarizes your finances all in one place. It can also generate reports and graphs to give you a visual perspective of your money. It comes with a mobile app, can track your finances, and can alert you when bills are due.

It costs $49.99 and is available for both Mac and Windows.

7. EveryDollar (now Ramsey+)–Best for Dave Ramsey Fans

For those Dave Ramsey founds out there, EveryDollar may be a good substitute for Intuit’s Quicken. Now the first thing to point out is that EveryDollar ain’t cheap. After a 14-day trial, you’ll pay $129.99 a year. If you want to try it for just 3 months, it will cost $59.99. For this reason, it’s not high on my list. Still, I know that some folks are passionate about Financial Peace University.

You can sync your bank accounts with the tool, set up budgets, and track spending. The budgeting app works on both computers, smartphones and tablets. It also comes with Dave’s educational materials, enabling you to take online course and join virtual groups.

8. Banktivity–Designed for Macs Only

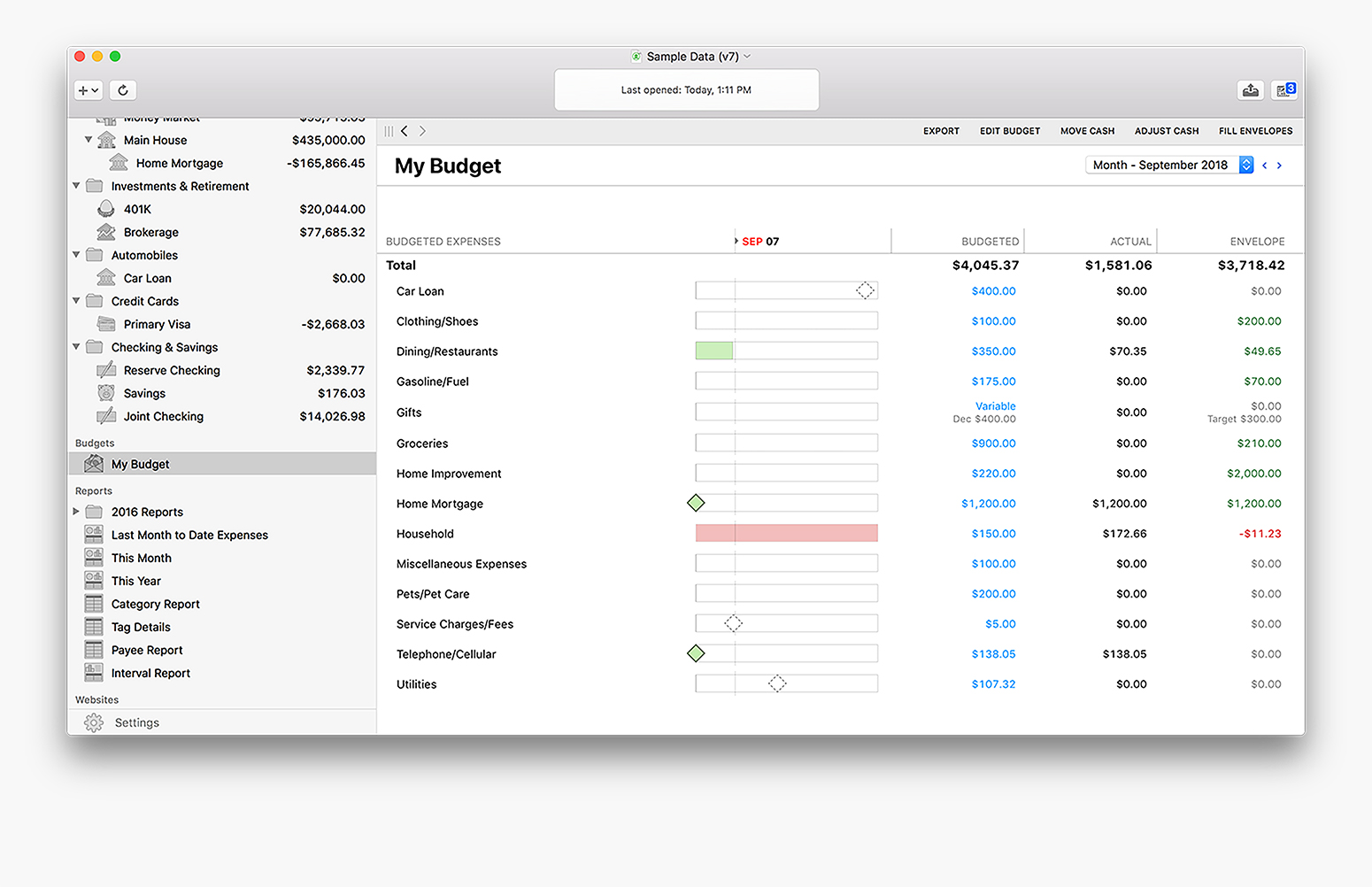

Banktivity is the budgeting app specifically designed for Macs. It offers features that enable you to organize and track all of your finances. You can group accounts and reports, and organize the dashboard in a way that works best for you.

Banktivity enables you to follow an envelope budget. This can be ideal for those living paycheck-to-paycheck.

You can import transactions from your bank and sync data across all of your Mac devices. Banktivity also tracks investments and offers account-level reporting. You can try Banktivity for free for 30 days. After that they offer three plans ranging in price from $4.16 to $8.33 a month (billed annually).

9. GnuCash–Best for Small Businesses

For those who tracked business income and expenses with Quicken and a reluctant to move up to Quickbooks, GnuCash may be the answer. It uses double-entry accounting, ideal for businesses and accounting nerds, like me. It tracks investments, schedules transactions, and generates reports and graphs.

10. Mint–Best Mobile App

I used Mint when it first came out more than a decade ago. Today, many are looking for Mint alternatives, including several of the apps listed here. Still, Mint is a worth consideration if you are replacing Intuit’s Quicken. It’s free, for starters. It’s easy to link your accounts and track your spending. It includes a budget planner and credit score tracker. Of course, there are great Mint alternatives as well.

11. GoodBudget–Best for Envelope Budgeting

I’m old enough to remember the envelope method of budgeting. My mom used it. When the money in the grocery envelope ran out, we stopped going to the grocery story until payday (seriously). Today, the envelope budget is still a smart way to manage money for those living paycheck-to-paycheck. If you want a digital version of the time-tested budgeting system, give GoodBudget a try.

Goodudget is an app based on the envelope system. You can sync and share your budget, and set goals to save for big purchases. It also has tools that let you track and payoff your debt.

Quicken Alternatives FAQs

What is the best free alternative to Quicken?Personal Capital is the best free Quicken replacement. It comes with nearly every feature Quicken offers, and money additional tools. It’s particularly well suited for those who want to manage all of their money in one place, including investments.

Is Quicken available without a subscription?Business Budget Software Reviews

Sadly, no. Like so many other software packages and apps, Quicken is now only available as a subscription.

Budget Software For Mac Free Download

What is the best option to migrate Quicken data to new app?If you want to migrate Quicken data to a new budgeting app, CountAbout is a solid option. It has features enabling users to migrate data from Quicken or Mint.

What is the best Quicken replacement for calendar budgeting?PocketSmith is a good choice as it offers a calendar view of your budget.

Which Quicken alternatives allow you to schedule bill payments?With both Tiller Money and YNAB, you can plan future bill payments. Tiller offers a Bill Payment Tracker template and YNAB enables you to allocate funds to bills you plan to pay in the future.

Free Home Budget Software For Mac

Whatever tool you choose, the key is to pick one that works for you. For me, that’s Personal Capital. One or more of the above Quicken alternatives, however, should suit the needs of most looking to better manage their money.